In today's digital landscape, seamless and secure payment processing is crucial for all business. Choosing the right credit card processing solution can significantly improve your operational efficiency and customer experience. By streamlining transactions, you can concentrate more time to expanding your core business activities.

A robust credit card processing solution offers a range of benefits. These include lowered transaction fees, rapid settlement times, and enhanced protection for both you and your customers. Furthermore, it allows for flexible payment options, accommodating the diverse needs of your clientele.

- Research your business requirements carefully to determine the most suitable credit card processing solution.

- Contrast different providers based on their fees, features, and customer assistance.

- Choose a provider with a strong track record in the industry.

By adopting advanced credit card processing solutions, your business can succeed in the competitive marketplace.

Unlock Seamless Transactions: Choosing the Right POS System

In today's fast-paced retail landscape, seamlessly processing transactions is paramount. A robust Point of Sale (POS) system can dramatically improve your checkout experience, boosting customer satisfaction and streamlining operations. With a wide array of POS systems available, selecting the right one can seem overwhelming.

- Analyze your business requirements. What features are essential for your sector?

- Prioritize ease of use and user accessibility.

- Explore different POS platforms and contrast their pricing.

Remember that the best POS system is the one that optimizes your workflow and fulfills your unique operational objectives.

The Future of Retail with POS Technology

Point-of-sale systems (POS) has evolved from simple transaction processing tools to dynamic, data-rich platforms that are transforming the retail landscape. With advancements in mobile solutions, cloud computing, and artificial intelligence, POS systems are now capable of providing a seamless and personalized shopping experience for customers while offering retailers valuable insights into customer behavior and inventory management.

The future of POS technology holds exciting possibilities featuring integration with augmented reality, virtual try-ons, and omnichannel commerce, blurring the lines between online and offline shopping. Furthermore, POS systems are expanding their reach beyond retail, powering diverse industries like hospitality, healthcare, and manufacturing.

Credit Card Machines: A Guide to Features and Functionality

In today's digital business landscape, credit card machines are essential tools for accepting payments. These versatile devices offer a range of features designed to enhance your transactions and increase customer satisfaction. From basic models to sophisticated systems, there's a credit card machine ideal for every business size and need.

A key feature to consider is the type of transaction processing supported. Classic machines are typically used by small businesses, while integrated systems effortlessly connect with your point-of-sale system for a more unified experience.

Furthermore, some machines offer features like gift card processing, loyalty program integration, and portable connectivity for added flexibility. When choosing a credit card machine, it's important to evaluate your business requirements, transaction volume, and budget. By thoughtfully considering these factors, you can find the perfect machine to efficiently handle your payment processing needs.

Optimize Payment Processing for Increased Revenue

In today's dynamic business landscape, optimizing your payment processing operations is essential for boosting revenue. By implementing efficient payment solutions and methods, you can minimize transaction costs, accelerate customer checkout experiences, and more info ultimately generate greater profitability.

- Concentrate on reliable payment gateways that offer multi-faceted fraud protection.

- Explore innovative payment options like mobile wallets and tap-to-pay technology to retain a wider customer base.

- Deploy data analytics to monitor payment processing trends and identify areas for improvement.

By proactively managing your payment processing workflow, you can position your business for long-term success.

Decoding Credit Card Processing: Everything You Need to Know

Credit card processing can seem like a complex and mysterious world, but it's really just a series of steps that allow businesses to accept payments from customers using credit cards. At its core, credit card processing involves transmitting information about a customer's purchase to their issuing bank for authorization and settlement. This process comprises several key players, including the merchant, the payment processor, the acquiring bank, and the issuing bank. When you make a purchase with your credit card, the merchant swipes or inputs your card information into their point-of-sale system. This data is then sent to the payment processor, which verifies the transaction with your issuing bank. If the transaction is approved, the payment processor delivers funds to the merchant's acquiring bank. The process can seem convoluted, but understanding these basic steps can help you make informed decisions about accepting credit card payments for your business.

- Grasping different types of payment processors is crucial for businesses.

- Security measures are vital to protect customer data during processing.

- Fees associated with credit card processing can vary widely, so it's important to evaluate different options.

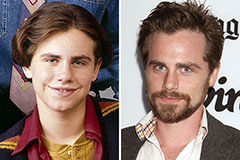

Rider Strong Then & Now!

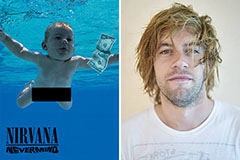

Rider Strong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!